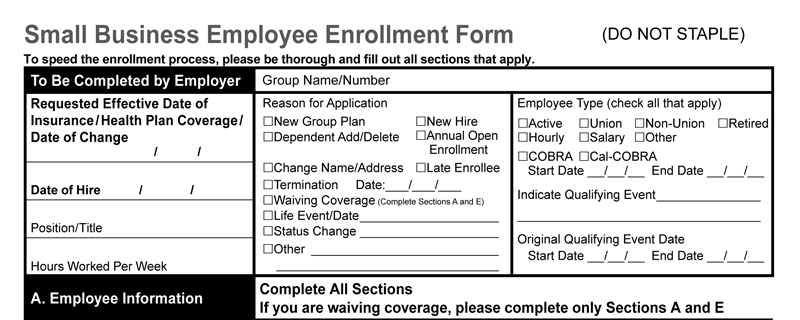

Example Small Business Employee Insurance Enrollment Form

By Bruce Jugan, June 24, 2021

API connections would eliminate data input errors and could save hundreds of millions of dollars and reduce the cost of medical insurance for small employers.

Imagine you log into Expedia and book a trip that includes an airplane flight, a hotel room, and a rental car. You think that you’re all set, and you start to pack your bags. Little do you know that in this imaginary world, behind the scenes, an Expedia employee receives an email instructing her to log into a portal and download three separate PDFs and then send an email to each company with your reservation request. The PDF is an electronic version of a paper application.

On the other end, an employee at the airline, hotel, and rental car company downloads the PDF and manually inputs your request into their company’s computer system. No confirmation is sent, so your Expedia rep must follow up to confirm that each company inputs your reservation correctly.

Sound far-fetched? Not when it comes to employees at small companies who enroll in medical, dental, vision, life insurance, and other employee benefits. That process describes exactly what happens today when employees at small employers (1-100 employees) in California enroll online. The biggest innovation in the past 100 years has been that the paper application is now electronic, meaning a PDF.

The problem with this antiquated application process is that it is time-consuming, labor-intensive, and results in numerous errors. Imagine going to the airport only to be told at the boarding gate that you don’t have a plane reservation, or you arrive in a new city and have no hotel room. With medical insurance, people often learn that they don’t have insurance coverage when they seek care at the doctor’s office or in the emergency room at a hospital. The financial consequence can be dire.

A better process – a 21st-century process- would be for insurance companies to do what the airlines, hotels, and rental car companies did decades ago: enroll members directly into their company’s computer system. They can do this by allowing third-party enrollment systems to connect directly to the insurance company’s computers. This would eliminate thousands of errors, needless delays, save money, and reduce the cost of medical insurance.

A Solution Exists

The good news is that we don’t need a technological innovation to accomplish direct enrollment, termination and plan changes for employees in small businesses. Insurance companies and third-party benefit administration systems can use what other companies use: an API connection. It’s secure and widely used by thousands of companies – from A to Z, or Amazon to Zoom.

API, or Application Programming Interface enables different computer systems to share information. An example of an API at work is when your Outlook or Google calendar updates your schedule after you accept a Zoom meeting invitation.

To enable an easy-to-use, secure API connection, insurance companies must adopt a standard format for data transfer. The good news is that LIMRA, an insurance company association, has created a data-sharing platform called “LDEx,” that enables enrollment systems to connect directly with insurance companies. Currently, only a few “ancillary” insurance companies use the standard system for managing group life, vision, dental, critical illness, and other non-medical insurance products.

There are software companies, like Noyo and ThreeFlow, that create API connections for small group medical insurance. Unfortunately, it seems that California medical insurance companies want small employers to enroll directly on their websites, meaning that Blue Shield of California wants employers to enroll on the Blue Shield web page, while Anthem Blue Cross and United Health Care want employers to use their portals.

Requiring employers, employees, or employee benefits brokers to use each insurance company’s website to manage benefits creates a big problem for small employers who may offer Anthem Blue Cross medical insurance alongside Kaisermedical coverage and Delta Dental coverage, and VSP vision coverage. Small employers and small group benefits brokers struggle to find the time and staff to learn each system, log in, and manage things separately.

Third-party applications like Ease and Employee Navigator currently exist for small employers and are typically paid for and supported by an employee benefits broker. These apps are like Expedia for employee benefits and they should seamlessly connect employees with each insurance company through API connections. Unfortunately, they don’t. They rely on fillable PDFs.

API connectivity would help consumers by eliminating waste, avoiding human input errors, and reducing the cost of coverage.

EDI is no API

Sadly, even large employers with fully insured or self-insured plans are stuck in the dark ages of technology when trying to connect to insurance company systems. “EDI feeds” or Electronic Data Interchange is the state-of-of-the-art data connection to an insurance company for most large employers (with 100 or more employees). EDI technology was developed in the 1970s and is akin to exporting an Excel spreadsheet in a specific format from one system to another. While an improvement over fillable PDFs, transferring data via an EDI feed in the second decade of the 21stcentury is like using a manual typewriter in the digital age.

Why haven’t Insurance Companies Embraced Technology to Enroll Small Employers?

Operating inefficiency due to outdated computer systems is well-known within the insurance industry. A 2017 article in Information Age noted that “Insurers are more steeped in legacy technology than any other industry” and they have “an implicit inability or unwillingness to reallocate resources [which] is one of the biggest challenges when it comes to insurance product delivery and operational efficiency.”

This article by an IT consulting firm paints an accurate picture of the current situation:

While other industries have moved beyond manually keying in data, many insurance companies are still holding onto old methods that not only make employees’ jobs harder but also result in an inferior product filled with data gaps and inaccuracies.

This McKinsey report, IT modernization in insurance: Three paths to transformation, suggests that insurance companies have not replaced legacy computer systems because they have focused their efforts on apps for consumers. The report says that “inattention has left most large insurers with parallel or redundant systems that drive up the cost of both maintenance and new feature development. In addition, quite a few insurers have decided to focus their IT investments on selective new front-end tools with immediately visible impact.”

Every medical insurance company in California has created a mobile app for consumers to have digital versions of ID cards and information on their plan benefits. These are clearly “front-end tool(s) with immediate visible impact.”

The sad reality is that California medical insurance companies have taken the easy road and created mobile apps and ignored the difficult task of updating their internal operating systems.

Regulators Should Force Insurance Companies into the 21st Century

Since medical insurance companies seem unwilling to improve their data sharing systems, it may be time for California state regulators to force change. There is precedence for government to force innovation.

In 2009, Congress passed the Health Information Technology for Economic and Clinical Health (HITECH) Act that encouraged doctors and hospitals to adopt and use electronic health records in a meaningful way. Perhaps now is the time for state and federal regulators to force medical insurance companies to update their systems to 21st century standards.

Another example of government forcing innovation came in 2018 when SB137 became effective and required California medical insurance companies to accurately list the doctors and hospitals in their provider directories. This law seems to have improved the accuracy of online medical provider directories.

California legislators or regulators could require medical insurance companies to adopt an industry standard for data sharing and require API connectivity for small group medical insurance. The technology exists. A government requirement would provide the incentive necessary to force all medical insurance companies to abandon 19th Century paper applications.

Small employers and benefits brokers are tired of waiting for insurance companies to join the 21st Century technological revolution. They are especially tired of the errors that occur because insurance companies haven’t updated their computer systems. Government should step in and force change.